How coffee farmers are losing income while losing their fair share of value

Coffee farmers have seen their income melt away over the years, while watching their coffee getting sold at an ever-increasing price to the consumer. Observation and solution.

Everyone knows and deplores the fact that coffee farmers today have insufficient income. Their situation has deteriorated so much in the last twenty years that many are abandoning coffee growing. At the same time, coffee has become some sort of « black gold » for the coffee industry; traders, speculators and roasters managing to extract ever more value from the consumer.

This model, made possible by financialization and increasingly opportunistic marketing, is not sustainable. To fully understand why roasting at origin represents today a unique opportunity to redefine the coffee sector at the global level, we need to go back a little on the “coffee economy”.

THE PRICE OF COFFEE IS VERY VOLATILE AND KEEPS GETTING LOWER

When people talk about the price of coffee, in the professional sphere, they refer to the price of “green” coffee, that is to say unroasted coffee.

The most commonly known is the FOB price of a pound (lb) of arabica coffee, listed in New York. When we talk about FOB (Free on Board) prices, this means that the coffee has been loaded in jute bags (and container) into the cargo ship at the port of departure. It therefore includes various port transport and manoeuvring, export procedures, in addition to the tasks specific to coffee exporters, such as bagging, certifying and other operations to constitute lots. Coffee farmers generally receive between 10% and 60% of this price depending on the production stage (at the level of washing, drying, deparchaging, sorting etc.) and local regulations. Farm Gate price is the purchase price from the coffee farmer.

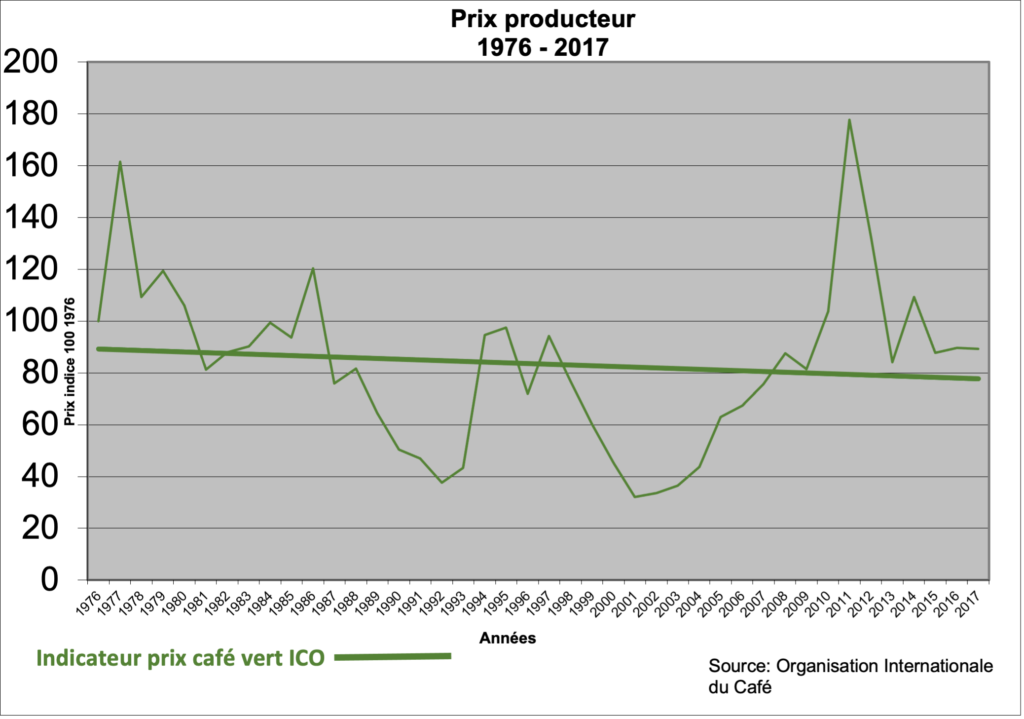

Here is the evolution of this price over the last 45 years :

The most worrying aspect of this price at first glance is its volatility. Indeed, it is very destabilising for the producing countries, and does not allow coffee farmers to plan and estimate their income. Considering that the production is usually sold in one go, and as soon as possible, if not in advance, as it is the only source of incoming revenue since… the last harvest. This does not make it possible to cost average the price of the production over the year by making successive partial sales. Green coffee prices influence 100% of coffee farmers’ income.

This volatility is the result of the financialization of the product as well as the (very… effective?) management of the different players of the coffee industry, in order to be able to obtain raw material for ever cheaper costs.

The global competition of all producing countries, regardless of their living standards and production costs, allows prices to be leveled down. All this disregarding terroirs, local cultures and of course social security models and economic structures.

In addition, the management of a « buffer » stock of green coffee in major Western ports gives importers strong bargaining power. This stock makes it possible, for example, to absorb bad years well. Indeed, when production falls, prices can rise without increasing tenfold, the only people being really penalized being the farmers who have lost part or all of their harvest. Similarly, it helps make the most of the good years: when production is high, prices can fall quickly since the industry already has a large stock.

Such a market gives buyers and speculators the opportunity to average cost their purchase price over one or more years. Knowing that speculators on futures contracts can cushion real price movements by betting upwards or downwards. And we will not even mention here the fact that green coffee has no vocation to improve over time and that it deteriorates in a few months under the commonly established storage conditions, one observation is very clear : producers are the weakest link in a chain where everything is done to ensure that the price of green coffee is optimized downwards.

This decrease is not made clear enough by the previous graph.

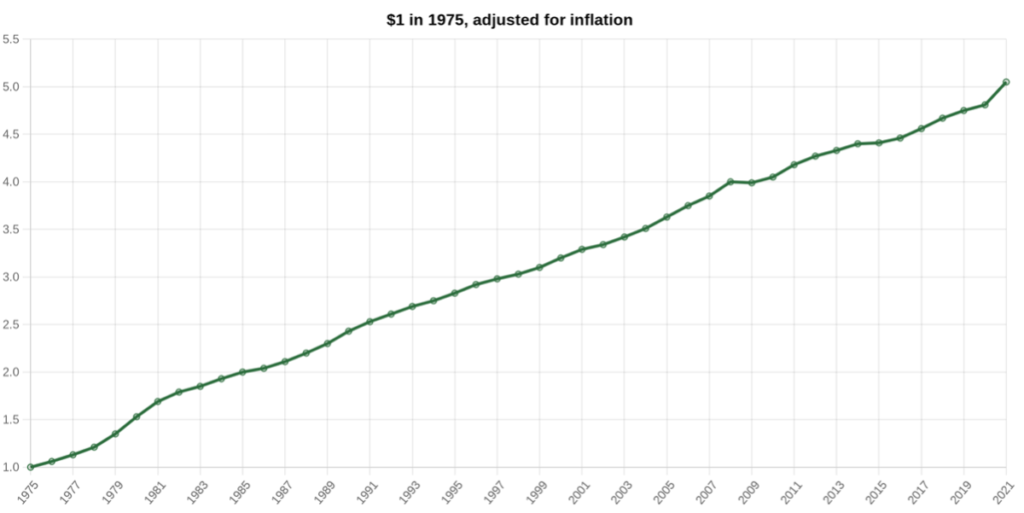

And if a simple linear trend line makes it possible to draw this decline in absolute terms (index 100 = $1.4), it is by taking inflation into account that the observation becomes very painful. Indeed, one U.S. dollar today is no longer worth as much as one U.S. dollar in the past. To see the impact, here’s what $1 from 1975 has been worth over time. Today, it’s more than $5 !

For example, in 1975, one of the worst years for coffee farmers’ income, the average price of arabica coffee was $0.65… But that’s still $3.28 of today, which is much more than the current price which for some people is in an « astronomical » increase. Following the same logic, the average price of arabica coffee in 1977, which was $2.31, would give us… $10.28 today! We are a long way from that. Very far even. Knowing that, as we will see in a future article, arabica is privileged compared to robusta coffee whose price (which is listed in London) generally evolves at a level twice as low. Robusta coffee farmers’ incomes are therefore twice as low as those already indecent of arabica producers.

And we are still surprised that bad practices (exploitation of workers, child labour, mechanization of crops, lack of investment in infrastructure, destruction of the environment) have become systematized in recent decades…

THE PRODUCERS’ SHARE IN THE FINAL PRODUCT KEEPS GETTING LOWER

Truth be told, the financialization of green coffee is only the first pain suffered by coffee producers. The second one, and perhaps the most dramatic, is that coffee keeps being sold at an ever greater price to the consumer, while their share in the final value keeps lowering.

In the 60s-70s, the share of green coffee still accounted for 60-70% of the final product (roasted coffee). In 2013, it barely reached 20% in average. The phenomenon has worsened with the development of special formats such as capsules or other pods, or with certification approaches such as “specialty coffee”. The paradox is that despite the purchase of green coffee at a higher price than the market price, the producer’s share in the final price paid by the consumer decreases.

These models imply an increase in profit margins both at the sourcing level and at the roasting level. And as we explained above, the price of green coffee is far from being equal to the producer’s income (FOB price vs the Farm Gate price).

The roasting of coffee, once a simple « basic » service that your grocer could offer to make your life easier, has become the alibi for capturing all the added value. A simple processing step of 15 minutes takes over the hundreds or even thousands of hours required to prepare the coffee bean. Roasting has become a myth to the point of appearing today as the act of ultimate sublimation revealing the riches of a bean that would otherwise be of no interest.

Coffee, which used to be the heart of the product if not the product itself, has become a simple attribute at the service of a product that is defined first and foremost by a brand and a marketing positioning. The coffee brand defines its products, offers ranges and styles, and establishes the bond of trust with the consumer. We invite you to discover the waves of coffee which summarize the great marketing universes invented by the coffee industry in the West.

And since it is crucial that this roasting takes place far from the origin to maintain the structure and pressure of the global green coffee market, when we are not practicing it ourselves in France, we import roasted coffee from Belgium, Italy, Switzerland, Germany, the Netherlands, Poland or the Czech Republic, whether through their brands or to provide our supermarkets private labels. And we impose customs duties on coffee roasted at origin, which do not exist for green coffee, in the name of free trade.

This does not prevent anyone from indicating countries of origin on what remains a food product, without enforcing on coffee the same requirements that we ourselves impose to avoid abuse of food products of French origin or manufactured in France.

THERE IS ONLY ONE SOLUTION : RETURN ROASTING TO PRODUCING COUNTRIES

Since green coffee has become excessively financialized, and roasting has isolated the producer from the consumer to the point of seeing the producer deprived of its fair share of value in the final product, the only solution is to start the opposite movement. Since roasting is now at the core of coffee, it must be carried out locally. Coffee farmers’ income must no longer be indexed to green coffee. And the price of coffee must no longer be decided at the level of the raw material, but be negotiated at the level of the finished product, as a whole, for a circular and solidarity economy.

One must not forget that the only reason why coffee is roasted in Europe today is that in the past we did not have the means to preserve roasted coffee well.

However, considerable progress has been made over the last decades, with high-quality triple-thickness packages, equipped with unidirectional valves, or even protective metal boxes. This is why the consumer can buy Italian, German, Czech or Polish coffees without any issue.

If up until the 1970s the sale of green coffee still made economic and technical sense (the prices of green coffee were honest, just like its share of value in the final product), this not only maintains structural poverty in many coffee-growing regions, but it no longer has any technical and logistical justification. And producers know this well thanks to the internet and sharing of the information.

The final obstacle is the strong barrier to market entry posed by the marketing firepower and the storytelling maintained by European roasters and the industry at large.

To return roasting to the producers, we at Alternative Café believe that the most effective and meaningful initiative is to enable producers of excellence, who have already empowered themselves and crafted their own coffees, to offer their roasted coffees to the European consumer today. Quality and authenticity are the strength of coffees roasted at origin because they speak for themselves.

We take care of facilitating regulatory and legal issues, by bringing them into compliance via our brand, without them having to look for the necessary financing to which they hardly have access anyway. The aim is to immediately multiply the incomes of coffee producers. It is through concrete examples of success that things can change at origin. We realized that the coffee world was not ready to take this step on its own and that it was therefore necessary to set an example so that the consumer can have a real alternative with this more sustainable model that responds to the current issues and the shared aspirations for a more ethical and sustainable world.

If the tasting of coffees from the best estates is a tool of choice to convince the consumer to change consumption habits, a work of explanation and education in relation to coffee and its economy is essential to generalize the roasting at origin beyond these exceptional coffees. That’s why we write articles like this.

Eventually, producers will be able to rely on labels, designations and protections, and have access to adequate means of financing to launch their own brands and export their roasted coffee, Alternative Café having served as their ambassador. And as we French people do when our agricultural products are abused or copied, they will eventually be able to have their legitimacy and the identity of their products recognized from a legal and commercial point of view. The future could not look more exciting !